May 14, 2025

International Credit Card Survey

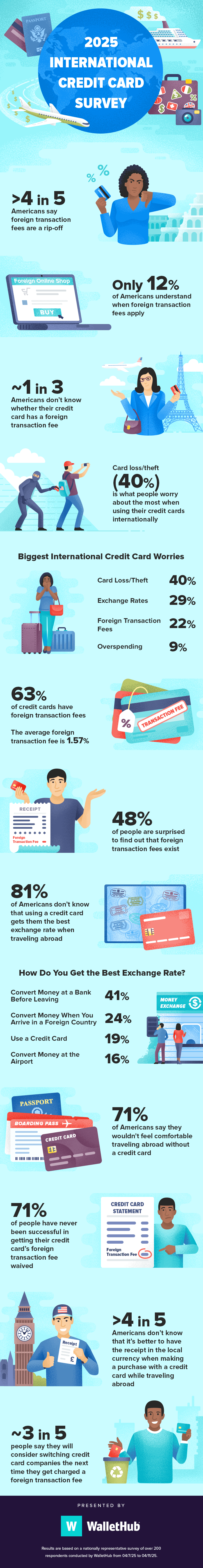

International travel is costly enough without having to pay extra just for swiping, dipping or tapping your credit card beyond U.S. borders. But foreign transaction fees are lurking, even domestically. Any purchase made through an international merchant and processed abroad is subject to a foreign fee.

To get a better understanding of what consumers know about foreign fees, how they influence our card choices and more, WalletHub conducted a nationally representative online survey. We asked people about everything from their international travel and spending habits to their biggest worries when using a credit card internationally. You can find the complete results in the following infographic.

Key Stats

- Predatory Practice: More than 4 in 5 Americans say foreign transaction fees are a rip-off.

- Ill-Informed Cardholders: Nearly 1 in 3 Americans don’t know whether their credit card has a foreign transaction fee.

- Few Understand Foreign Fees: Only 12% of Americans understand when foreign transaction fees apply.

- Exchange Rate Savings: 81% of Americans don’t know that using a credit card gets them the best exchange rate when traveling abroad.

- Receipts in Local Currency: More than 4 in 5 Americans don’t realize that it’s better to have the receipt in the local currency (not in U.S. dollars) when making a purchase with a credit card while traveling abroad.

- Prepared to Switch Banks: Nearly 3 in 5 people say they will consider switching credit card companies the next time they get charged a foreign transaction fee.

Copyright 2025 Evolution Finance, Inc. (dba WalletHub). All rights reserved. From https://www.wallethub.com.

By John S. Kiernan, WalletHub Managing Editor.

To view all articles, check out the

Internet Travel Monitor Archive